How Long Does It Take To Get A Cashier's Check

A cashier's check is a form of guaranteed payment that is paid with a bank's own funds, rather than with money from a personal account. Because cashier's checks are signed by a bank employee and backed by the bank itself, they're considered safer than personal checks, which may be returned or "bounce" if the issuer doesn't have enough money to cover the written amount. You can get a cashier's check by requesting one at your local bank branch and permitting them to debit the funds from your bank account.

- Definition of a Cashier's Check

- How and Where to Get a Cashier's Check

- Cashier's Checks vs Certified Checks and Money Orders

- Avoiding Cashier's Check Scams

Definition of a Cashier's Check

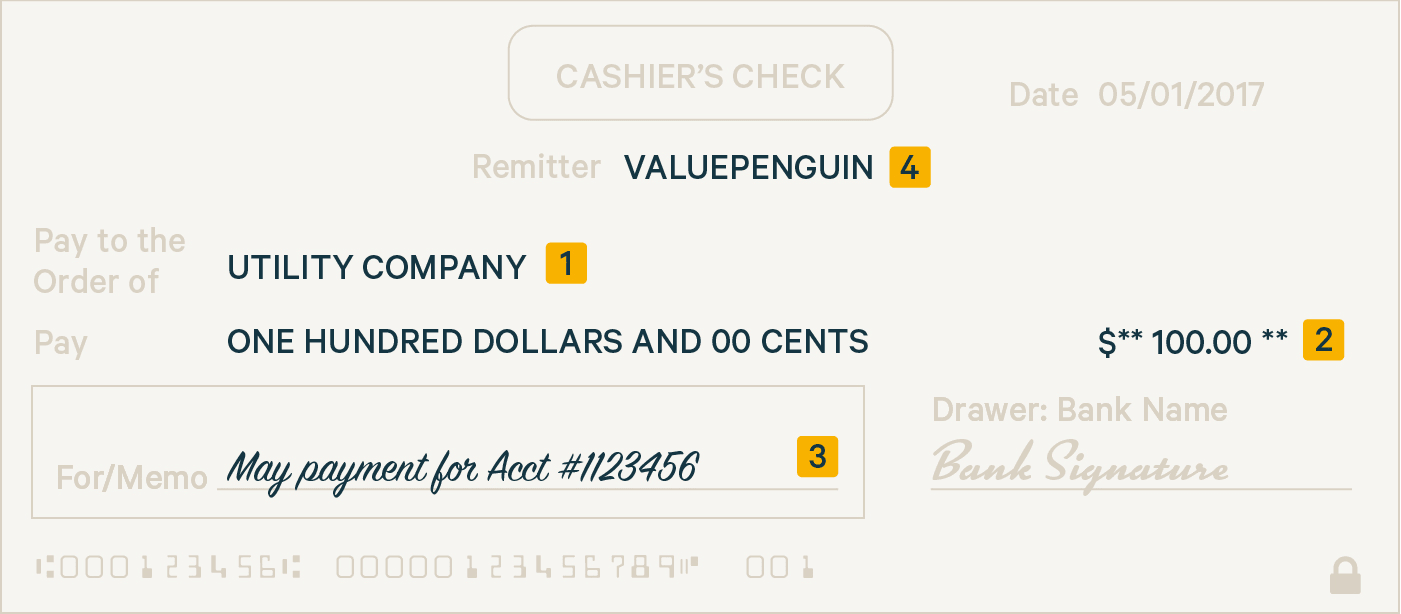

A cashier's check looks much like a personal check, but it carries the signature of a bank teller or cashier instead of the purchaser. When you buy a cashier's check at a bank, you designate the recipient and the amount, and the bank takes that money immediately from your account. From that point on, the bank is responsible for paying the recipient, who can now deposit the cashier's check and receive the funds. Payment usually clears within one day, making cashier's checks much quicker than other forms of payment.

1. Payee's Name. The full name of the individual or company that will receive the dollar amount printed on the cashier's check. Only the named individual or a verified agent of the company will be able to deposit the check.

2. Payment Amount. The total sum of money that the payee will receive upon depositing the cashier's check. This amount is transferred from the remitter's account to the bank as soon as the check is issued, along with any fee for the service.

3. Memo. Any notes you wish to include may be printed in this space. As with personal checks, memo lines can be useful in clarifying the purpose or final destination of a given payment, whether that means including your account number at the utility company or the address of the home for which you're paying rent.

4. Remitter. The name of the person who paid for the cashier's check. While the bank is always responsible for the final payment of the check, the remitter is the one who initially orders the check and transfers funds over to the bank for that purpose.

How and Where to Get a Cashier's Check

Obtaining a cashier's check requires visiting a bank or credit union, but not every place issues cashier's checks to non-customers. The few that do will often charge extra for the service. This means it's most logical to start looking at your own bank, where you can have the necessary funds transferred out of your existing checking or savings account.

Cost of Cashier's Checks by Bank

While prices can vary by state, we collected a list of the prices you can expect on cashier's checks at a dozen major banks.

| Bank | Cashier's Check Fee |

|---|---|

| Bank of America | $10 |

| BB&T | $10 |

| Capital One | $10 |

| Chase Bank | $8 |

| Citibank | $10 |

| Huntington Bank | $6 |

| KeyBank | $8 |

| PNC Bank | $10 |

| Regions | $8 |

| SunTrust | $8 |

| TD Bank | $8 |

| US Bank | $7 |

Show All Rows

Many of these banks offer free cashier's checks to their premium checking account-holders, who pay higher maintenance fees or meet higher minimum deposit requirements in exchange for more bank services. While most people don't use cashier's checks frequently enough to justify getting premium checking, there's no reason to avoid the higher-tier account if your average balance is high enough to keep the fees away. Typically, banks charge from $25 to $30 each month in maintenance on a premium checking account, which roughly translates to three or four cashier's checks per month.

Cashier's Checks vs. Certified Checks and Money Orders

Cashier's checks aren't the only form of guaranteed payment. Certified checks combine characteristics of a personal check with those of a cashier's check: a bank issues a certified check as proof that the payer has enough money to cover it. Then, the bank sets aside the amount of the check until the recipient cashes it. The difference is that cashier's checks are paid by the bank, while certified checks get paid out of personal accounts. Functionally, however, there isn't any big difference between certified and cashier's checks.

Money orders are a cheaper but limited alternative to checks. Rather than going to a bank to draft a check, you can purchase a money order from the post office or a Western Union location. While money orders have a $1,000 limit on their value, they are just as safe as cashier's checks and certified checks. They may not be backed by any bank, but millions of people around the world rely on money orders as a guaranteed way to transfer funds. Money orders only cost a few dollars each, making them more cost-effective than a cashier's check if you're sending smaller amounts.

Avoiding Cashier's Check Scams

Unfortunately, the speedy processing of cashier's checks makes them a common target for forgeries and scams. In the US, the Office of the Comptroller of the Currency (OCC) will issue alerts about counterfeit cashier's checks that have been reported across the country. When you have doubts about a cashier's check you've received, you can check the name of the issuing bank against the list of recent OCC alerts.

Because banks are required to make the funds from a cashier's check available within one day, a fake check will often escape detection until the payee has already received the money. When a counterfeit is discovered after the deposit, the bank will take back the funds from the payee, which can cause terrible problems if the funds are already withdrawn or spent.

As a rule, you should not accept cashier's checks as payment for an online transaction, such as a sale through eBay or craigslist. In such situations, online payment services like Venmo are more appropriate. For especially large transactions, an even safer choice is to engage an escrow service, which involves a third party company that holds all the funds involved in a transaction until both parties approve the transfer.

How Long Does It Take To Get A Cashier's Check

Source: https://www.valuepenguin.com/banking/what-is-a-cashiers-check

Posted by: vanmetersamintme.blogspot.com

0 Response to "How Long Does It Take To Get A Cashier's Check"

Post a Comment